A few months ago, the Gübelin gemological laboratory announced the introduction of a new certification and traceability procedure for emeralds: the Emerald Paternity Test. We spoke to you at length about it here and we mentioned its application but also the consequences, the legal and ethical questions that arose from it. At a time when the question of gem traceability is becoming an increasingly important issue for jewellery houses and customers, the laboratory has announced a major partnership with the company Everledger to go a step further as the global jewellery industry seeks to move towards greater transparency. We therefore took a look at the application of blockchain technology, how it works and its possible flaws, and we asked the laboratory and Mr Daniel Nyfeler – Gübelin’s Managing Director – to tell us more about this technology.

1- What is blockchain?

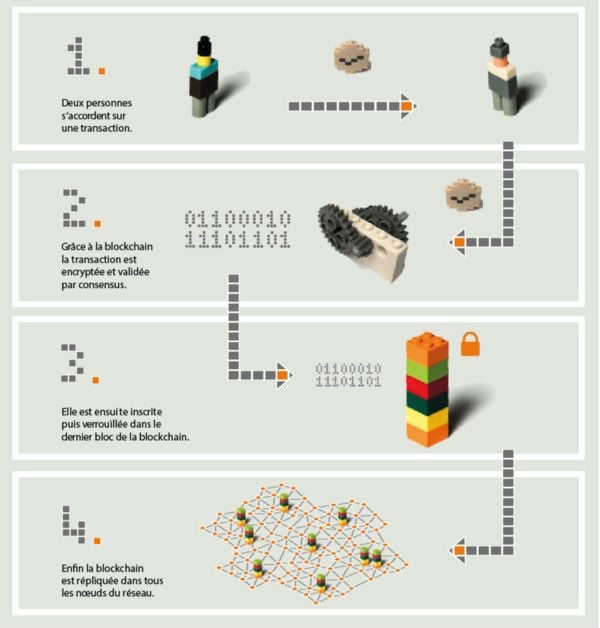

Infographic from the book “Understanding Blockchain”. u Change

To talk about this technology, we must first understand what it is. The current definition explains that the Blockchain is a technology for storing and sharing data. It allows the transmission of information without a control body because all users of the chain can verify the validity of the elements that make it up. The information that it contains is then verified (it must not conflict with previous information), linked, grouped into blocks and then secured by an encryption system that – in principle – makes the chain inviolable. It can be defined more broadly as a database or an openledger that manages the various transactions and archives them without any possible modifications. In short, a huge virtual police book with no trusted third party.

In recent months, the technology has been causing a stir in the financial markets as it is the foundation of emerging crypto-currencies such as Bitcoin. You may wonder who is behind this system. As with many topics related to the internet, the question remains. For a long time, there was talk of the American engineer Dorian Nakamoto, but also of the Australian businessman Craig Steven Wright. All have denied it. And the mystery persists. In any case, the system is today acclaimed by thousands of users and has now entered into the French Monetary and Financial Code throughOrdinance No. 2017-1674 published on 8 December 2017.

One question remains, can the blockchain be private? The answer is yes, we speak then of a consortium chain. Here the governance of the chain comes from one or more companies / institutions that manage it. They can then issue authorisations to write and define the protocol(Rule book). At the same time, they decide on public or restricted access to the chain’s information. At first sight this is contrary to the principles of the system, but most observers will tell you that the strength of a blockchain lies precisely in its length and its transparency. This is what gives it its value. But there is nothing to stop it being privatised.

What about the law? The legal question first raises the issue of ownership and then that of litigation. In the case of gems, as with everything else, the subject is vast and complex depending on the country to which it belongs. As we are talking about commercial acts, there is a good chance that the law retained in the event of disputes will be that of the country of the transaction and we could go even further and say that it is the law of the country where the blockchain is created that could govern it and the related acts. Paris, London, New York, Rio de Janeiro… Each country has its own law. As you can see, the legal subject is as fascinating as it is complex. On this subject, I can only recommend the excellent article by Hubert de Vauplane in Les Echos. As a lawyer, he goes further than my thoughts and analyses the legal issues of blockchain in a broader way.

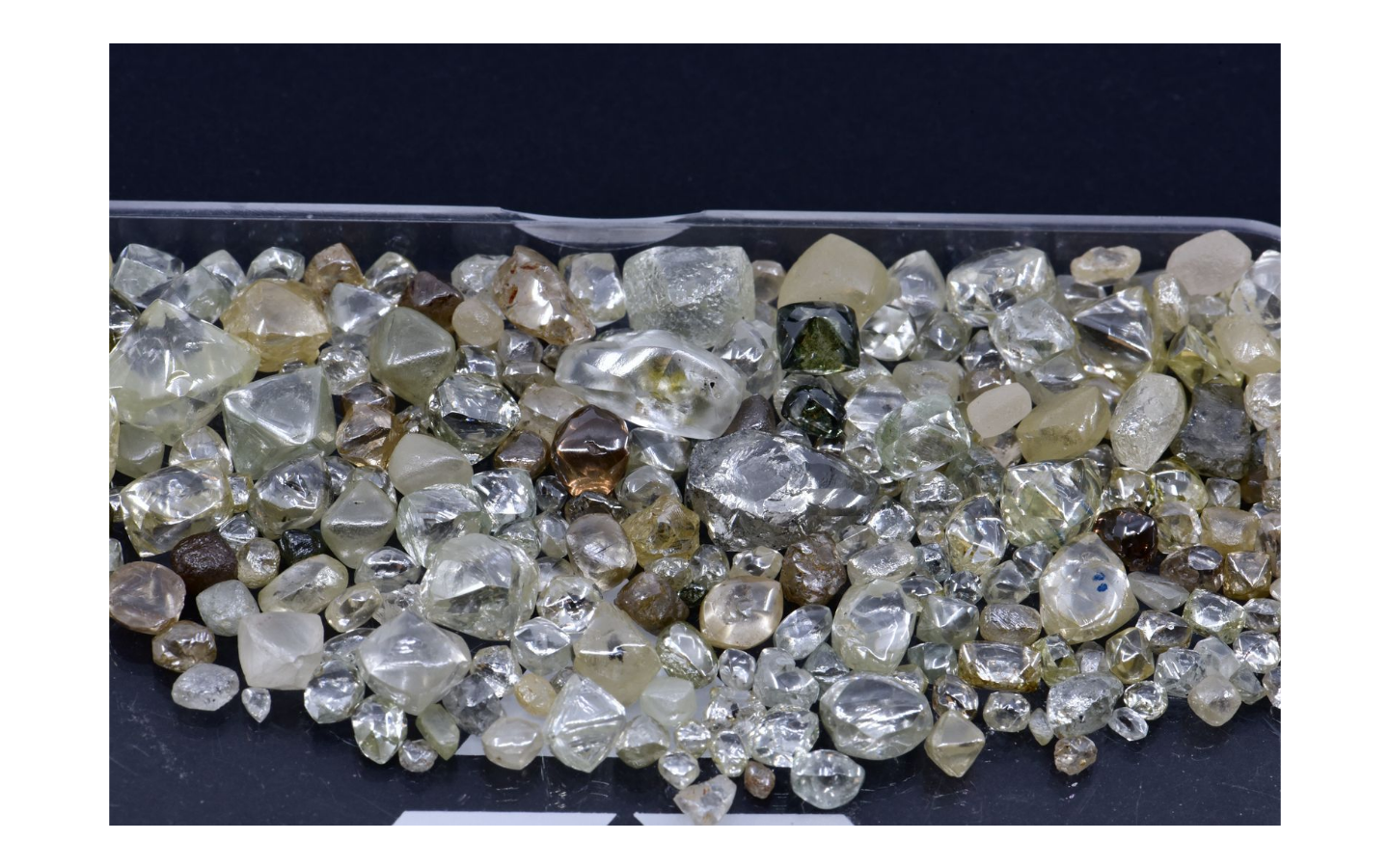

2- Blockchain and diamonds, a new global challenge?

In the jewellery industry, the use of this technology is fairly recent. It corresponds to a desire to go beyond the Kimberley Process for diamonds and to create a chain of trust in the sourcing of coloured stones. The raging debate on synthetic diamonds, the flaws of the KP but also the lack of a real certified sourcing system for other gems has thus pushed the industry to think about new solutions or to consider the application of technology not initially conceived for jewellery, as is the case of the Blockchain. In early December 2017, De Beers announced it was investing in the system to guarantee the provenance of its diamonds from mining to the end customer.

Leanne Kemp. Photo: Everledger

In reality, the system has been developing for a few years. Everledger appeared on the market (and on this topic) back in 2015. But at the time, not many people were talking about it and crypto-currencies were not yet a big hit. Behind this London-based start-up is Leanne Kemp, an Australian with a degree in accounting and business. Her professional experience will lead her to technological developments allowing the traceability of commercial acts and more particularly RFID (radio identification systems for objects such as barcodes). From 2010, she trained in the fight against cyber-crime and then in gemmology (GIA). Entrepreneur, passionate about new technologies, she initiated several projects and multiplied start-ups related to the identification and tracking of goods. In 2007, she joined the Canadian company Phenix Jewellery as Director of International Strategy. In 2015, she began working on the application of blockchain to diamonds through the Barclays Accelerator programme (initiated by the bank of the same name) and then launched her company Everledger. The company’s goal is to provide an unalterable digital record to all stakeholders in the life cycle of a diamond so that every change from the time it is mined can be recorded. This logbook will then go to the owner of the stone, and eventually to the next ones (provided they continue the chain). Nearly two million diamonds are already registered in the system. In June 2017, the Singapore Diamond Investment Exchange announced that it would guarantee all its transactions with this technology.

3- What about coloured stones?

It is precisely on this subject that the Gübelin announcement is unprecedented. By announcing a partnership with Everledger, the laboratory intends to allow greater transparency in the trade of stones other than diamonds, which are not regulated in any way because there is no traceability system like KP. As Mr Nyfeler told us,“the system collects all the information, constituting a grey card of the stone over time.It is the concept of data integrity – at the base of the chain – that makes the technology attractive. By preventing changes (which would invalidate the chain) we can thus deliver perfectly transparent information.“

Indeed, the system offers more than 40 points of information to establish an identity card: origin, extraction date, inclusions, weight, colour, size, certification date, etc. Then any type of information can be added to trace the gem: sale at a tender, new owner… There is no limit to the transparency. The ultimate goal is to make a trade often considered opaque (because it is complex and involves many intermediaries) more accessible, but also to completely reassure customers who are now demanding written proof.

That said, questions arise. When the stone leaves the system (after being sold to a private individual, for example), how can we be sure of what will happen next? What if the stone is re-cut? “All chains can be broken if the last person to come into possession of the stone does not wish to continue it. In the lab, we believe it makes sense to continue this one because the full history of a stone adds substantial value to the gem. Re-cutting and re-polishing is not a problem. It’s just additional information that reflects the life of the stone involved in the chain like a certificate number or laser engraving.“

If the subject of the diamond trade is already complex, the subject of coloured stones is even more so. Indeed, a great many operations are artisanal and control is particularly difficult. It is therefore to be expected that it will further reinforce the importance of the large mining groups such as Gemfields, Alrosa, or Rio Tinto whose power is no longer to be demonstrated. The initiative is undoubtedly worth following. If the trade in stones (diamonds or others) has always been based on the trust of the word given, it is no longer possible to be satisfied with this alone. Too many actors and economic interests are at stake. We cannot say if blockchain will be the relevant answer to the growing demands of professionals and individuals alike, but the issue of traceability and this initiative are in any case proof of a change in the gem trade.

See you soon!